4109 Reed Rd

Houston, TX 77051

(Corner of Reed & Scott — Across from Worthing HS)

Get up to $7,500 Cash Advance Starting January 2!

Book Your Appointment Today

C & J TAX SERVICES MISSOURI CITY

Accurate, Reliable, and Stress-Free Tax Preparation

At C & J Tax Services, we simplify the complexities of tax season with expert guidance tailored to your unique needs. Whether you’re filing as an individual, a small business owner, or managing complex finances, our experienced team is here to provide accurate, reliable, and efficient solutions.

INTRODUCTION

About Our Trusted Tax Professionals

Welcome to C & J Tax Services Missouri City, where we’ve proudly served the Missouri City community since 2019. With a combined experience of over 25 years, our team is committed to delivering exceptional tax preparation services that you can trust.

Our Mission

Our Vision

To ensure that our clients pay the lowest legal amount of income tax while staying fully compliant with tax regulations. We achieve this by offering personalized, accurate, and efficient solutions tailored to each client’s unique needs.

To empower our clients through education on tax laws and best practices, enabling them to make informed decisions and optimize their financial success. We strive to be a trusted partner, offering the expertise and guidance needed to navigate the complexities of the tax system with confidence.

At C & J Tax Services Missouri City, we combine professionalism, integrity, and a passion for excellence to make tax season stress-free and rewarding for our clients.

OUR SERVICES

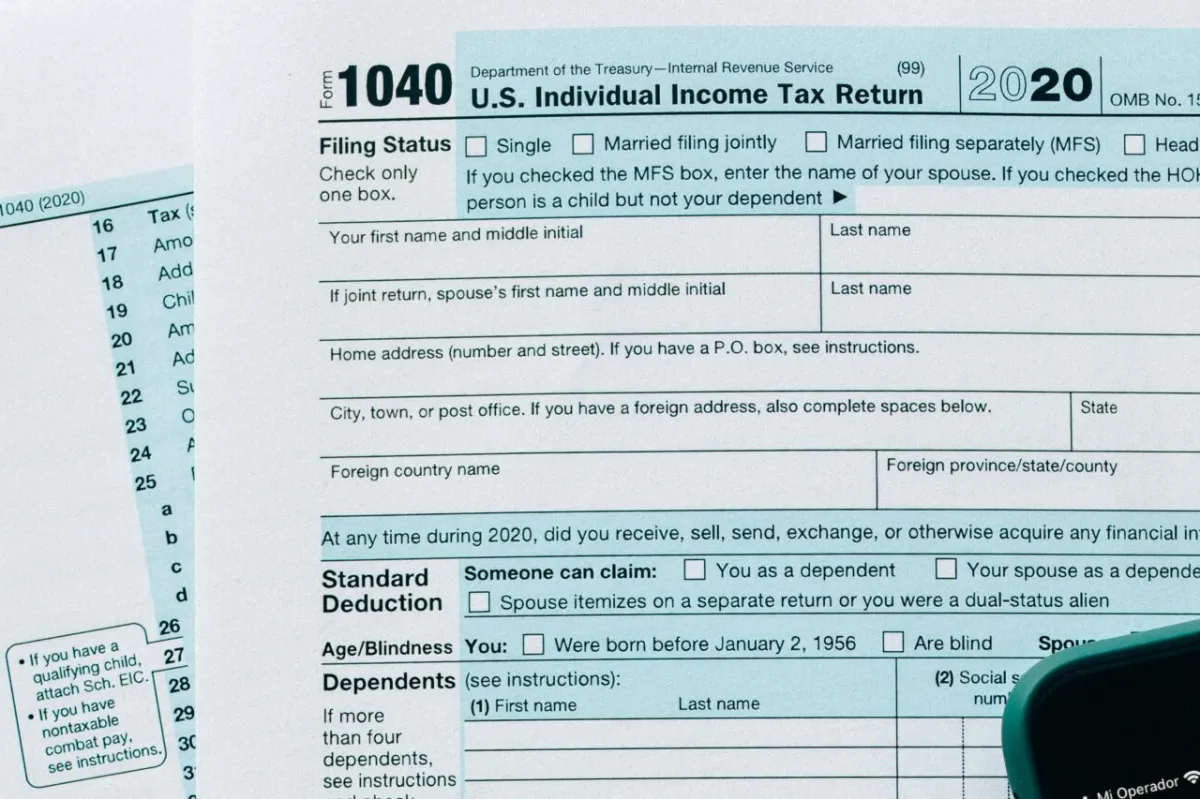

Tax Preparation

We provide accurate and personalized tax preparation services to help you maximize your refund and minimize your tax liability. Whether you’re an individual, a small business owner, or filing jointly, our experts are here to guide you every step of the way.

OUR SERVICES

Tax Preparation

We provide accurate and personalized tax preparation services to help you maximize your refund and minimize your tax liability. Whether you’re an individual, a small business owner, or filing jointly, our experts are here to guide you every step of the way.

OUR SERVICES

Tax Preparation

We provide accurate and personalized tax preparation services to help you maximize your refund and minimize your tax liability. Whether you’re an individual, a small business owner, or filing jointly, our experts are here to guide you every step of the way.

OUR SERVICES

Tax Preparation

We provide accurate and personalized tax preparation services to help you maximize your refund and minimize your tax liability. Whether you’re an individual, a small business owner, or filing jointly, our experts are here to guide you every step of the way.

Meet Our Team

Get to know the dedicated professionals behind C & J Tax Services Missouri City.

Our Community Impact

Spreading Joy in Our Community

At C & J Tax Services, we believe in giving back and creating moments of joy that bring our community together. Recently, we had the privilege of hosting a Free Santa Photo Event, a special day filled with smiles, laughter, and holiday spirit.

This page is dedicated to showcasing our efforts to connect with and give back to the people who make our community so special.

Watch the highlights from our event and thank you to everyone who participated and helped make it a success. Together, we’re building not just businesses but stronger communities.

Have an idea for our next community event? We’d love to hear from you! Contact us at [email protected] to share your thoughts.

FAQ’S

Frequently Asked Questions About Tax Preparation

Filing your taxes can feel overwhelming, but we’re here to make it simple and stress-free. Below, you’ll find answers to the most common questions we receive. If you have additional questions, don’t hesitate to contact us or schedule a consultation.

What documents should I bring to file my taxes?

A valid photo ID (e.g., driver’s license, state ID).

Social Security numbers for yourself, your spouse, and any dependents.

Income documents, such as W-2s, 1099s, or self-employment income records.

Proof of deductions or credits (e.g., mortgage interest, tuition expenses, childcare costs).

Bank account and routing numbers if you’d like to set up direct deposit.

Bring any additional tax-related documents you may have received for the year.

Do I need to file a tax return if I didn’t work all year?

Filing a tax return is not always required if you didn’t earn income. However, you may still want to file if:

You had taxes withheld and want to claim a refund..

You’re eligible for tax credits, such as the Earned Income Tax Credit (EITC).

You received unemployment benefits or other taxable income

We can help you determine whether filing is necessary or beneficial for your situation.

I have a business. Do I need to bring all my receipts?

While you don’t need to bring every receipt, it’s essential to bring a summary of your business income and expenses for the year. Supporting documents can include:

Profit and loss statements.

Bank statements..

Receipts for major expenses.

Keeping detailed records helps ensure your return is accurate and maximizes your deductions.

When can I expect to receive my tax refund?

Most tax refunds are issued within 21 days of the IRS accepting your return, but this timeline can vary based on:

Whether you e-filed or mailed your return.

The complexity of your tax situation.

IRS backlogs or additional reviews.

We’ll provide you with an estimated refund timeline based on your filing method.

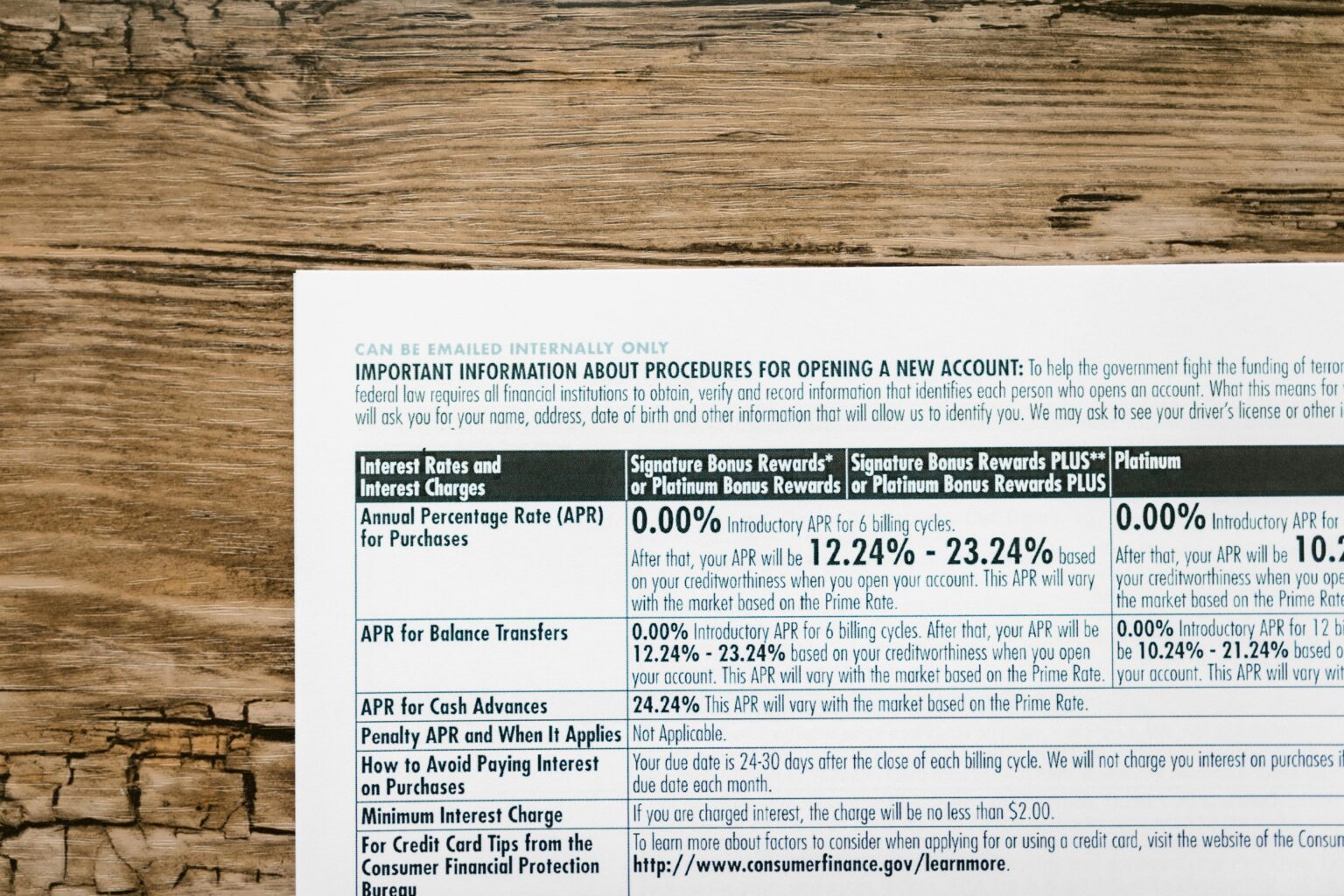

How do I qualify for a tax refund advance?

To qualify for a tax refund advance, you must:

Have your taxes prepared and filed with us.

Provide all necessary documentation to complete your return.

Meet eligibility requirements set by the refund advance program.

Refund advances are typically issued within 24-48 hours of approval. Contact us to learn more about how you can apply.

How do I know if I owe money to someone?

If you suspect you owe money or that your tax refund may be reduced due to an offset, you can check your status by contacting the Treasury Offset Program. Follow these steps:

Call the Treasury Offset Program’s Phone Line: Dial 1-800-304-3107.

Follow the Automated Prompts: Provide the requested information, such as your Social Security Number, to verify your identity.

Listen for Details: The system will inform you if your refund is being offset and who the debt is owed to.

The Treasury Offset Program matches outstanding debts (like federal loans, child support, or unpaid taxes) to taxpayer refunds. If you owe money, this service helps you identify the debt and take steps to resolve it

OUR BLOG

Our Latest Posts

How to Qualify for a Tax Refund Advance

Need your refund faster? Here’s how a tax refund advance…

How to Qualify for a Tax Refund Advance

Need your refund faster? Here’s how a tax refund advance…

How to Qualify for a Tax Refund Advance

Need your refund faster? Here’s how a tax refund advance…

PRODUCTS

Products List

Plans & Pricing

Services

Partners

COMPANY

News

Contact Us

About Us

Meet Our Team

RESOURCES

Gallery

Blog Articles

Brand Assets

Brand Guidelines

SUPPORT

Knowledge Base

Contact Support

Privacy Policy

TOS

Copyright © 2024-- All rights reserved